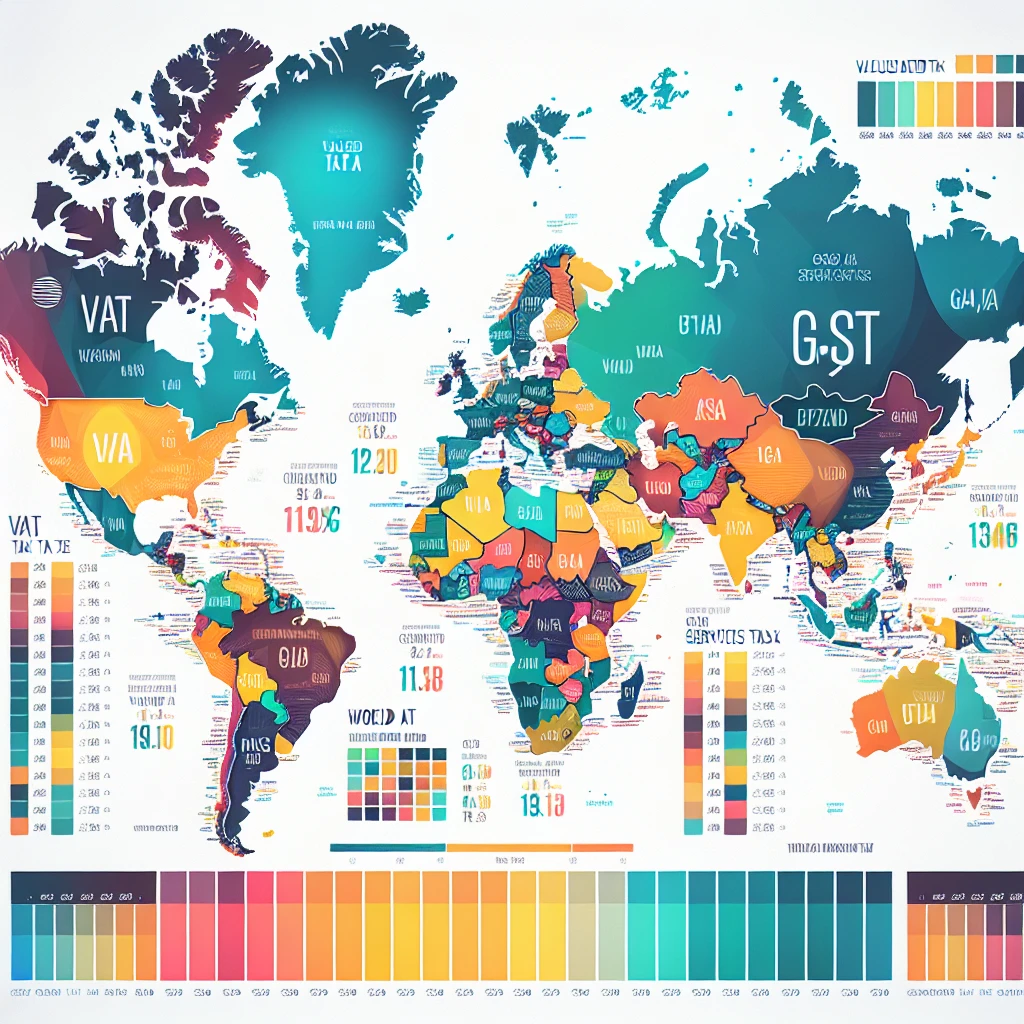

Understanding Global VAT/GST Rates

When selling across borders, understanding the labyrinth of global VAT/GST rates is as crucial as it is complex. These rates are not only varied across different countries and regions, but they are also subject to frequent changes and updates, making compliance a moving target for ecommerce businesses. For instance, while Europe generally hovers around a standard 20% VAT rate, countries like Japan impose a relatively lower 10% consumption tax, and some countries in the Gulf Cooperation Council have only recently introduced VAT at 5%.

What's more, certain product categories may be taxed differently within the same country, adding another layer of complexity. For example, books might have a reduced rate in one country while being exempt in another. This intricate web of rates demands that ecommerce entrepreneurs stay informed and agile. To effectively navigate this maze, one must leverage resources like VAT/GST compliance best practices and consider the use of technology solutions as discussed in leveraging technology for VAT/GST management.

Here's a snapshot of how VAT/GST rates can differ:

- European Union: Standard rates around 20%, with reduced rates for certain goods and services.

- Japan: A flat 10% consumption tax on most goods and services.

- Gulf Cooperation Council: Newly introduced VAT at 5%.

- Australia: 10% GST on most goods, services, and other items sold or consumed.

For ecommerce businesses, these variations mean pricing strategies must be finely tuned to reflect the correct tax rates, ensuring that neither profitability nor compliance is compromised. It's a delicate balance, but with the right knowledge and tools, it's entirely manageable.

Compliance Challenges in Cross-Border Ecommerce

When it comes to cross-border ecommerce, the compliance landscape is as diverse as it is demanding. The challenge begins with understanding that each country has its own set of VAT/GST regulations, which can be a daunting task for businesses expanding their reach internationally. The complexity is further compounded by the need to keep abreast of frequent changes in tax laws, which can vary not only from country to country but also within different regions of the same country.

For ecommerce businesses, this means that there is no one-size-fits-all approach to tax compliance. Instead, they must navigate a patchwork of tax jurisdictions, each with its own rules and rates. This requires a robust system to manage and update tax compliance information continually. Failure to comply can lead to hefty fines, legal issues, and a tarnished brand reputation. Here are some of the specific challenges ecommerce businesses face:

- Registration Requirements: Businesses must determine if they need to register for VAT/GST in each jurisdiction where they have a taxable presence, known as a 'nexus'. This can be particularly tricky when selling online, as digital goods and services often trigger tax obligations in multiple locations.

- Rate Application: Applying the correct tax rate can be a nightmare given the variations in rates for different product categories and services. It's essential to accurately classify products to apply the appropriate tax rate, which can be a meticulous and error-prone process.

- Reporting and Filing: Each jurisdiction has its own reporting requirements and filing deadlines. Keeping track of these and ensuring accurate and timely filings is a significant administrative burden for businesses.

- Audits and Compliance Checks: The risk of being audited increases with the number of jurisdictions in which a business operates. Preparing for and responding to audits requires a deep understanding of local VAT/GST laws and meticulous record-keeping.

Moreover, the digital age has introduced digital services taxes (DST) in some jurisdictions, adding another layer to the compliance puzzle. To stay ahead, savvy ecommerce operators are turning to specialized software solutions and professional advice to ensure they remain compliant across borders. For instance, integrating with a platform that automates tax rate application and reporting can be a game-changer, as highlighted in leveraging technology for VAT/GST management.

In conclusion, while the challenges are significant, they are not insurmountable. With careful planning, the right tools, and a proactive approach to tax compliance, ecommerce businesses can thrive in the global marketplace. For more insights, consider exploring VAT/GST compliance best practices to build a solid foundation for your cross-border ventures.

Strategies for Managing Multiple VAT/GST Rates

Managing multiple VAT/GST rates effectively is crucial for ecommerce businesses operating across borders. It's not just about staying compliant; it's about maintaining profitability and ensuring a seamless customer experience. Here are some strategies that can help you navigate this complex landscape:

- Automated Tax Software: Invest in robust tax software that automatically updates VAT/GST rates and rules as they change. This reduces the risk of human error and saves time that you can invest back into growing your business.

- Product Classification: Develop a detailed system for classifying products according to the different VAT/GST rates. This might include creating a comprehensive database that aligns your products with the correct tax codes.

- Real-Time Tax Rate Calculation: Utilize tools that provide real-time tax calculations at checkout. This ensures that customers are charged the correct amount of tax, no matter where they are located.

- Regular Training: Keep your team informed and trained on VAT/GST regulations. Regular training sessions can help prevent costly mistakes and ensure that everyone is up-to-date on the latest tax laws.

- Professional Consultation: Don't hesitate to seek professional advice. Tax experts can provide insights into tax optimization strategies and help you navigate the complexities of international tax laws.

Implementing these strategies requires an initial investment, but the payoff is significant. Not only does it streamline your tax management process, but it also fortifies your business against potential fines and penalties associated with non-compliance. Moreover, it positions your business as a trustworthy and reliable vendor in the eyes of your customers.

For a deeper dive into the intricacies of VAT/GST management, consider reading Understanding VAT and GST: A Primer for Ecommerce Entrepreneurs and Accounting for VAT/GST in Ecommerce: A Step-by-Step Guide. These resources can provide you with a more comprehensive understanding of how to manage VAT/GST rates effectively.