Ecommerce Bookkeeping Services: How-To Guide + 6 Bookkeeping Differences

As an ecommerce owner, whether you’re selling on Shopify or on Amazon, it’s important to really understand the nuances and complexities of your ecommerce bookkeeping — what makes it different from any other bookkeeping process? The short answer is … a lot. Understanding the differences and how to account for them will help you get the most value and insights from your financials and prevent major issues down the line. More importantly, it will give you the tools to review the quality and relevance of your current books to make sure you aren’t paying a lot for bookkeeping that is essentially irrelevant for your business. Let’s dive in.

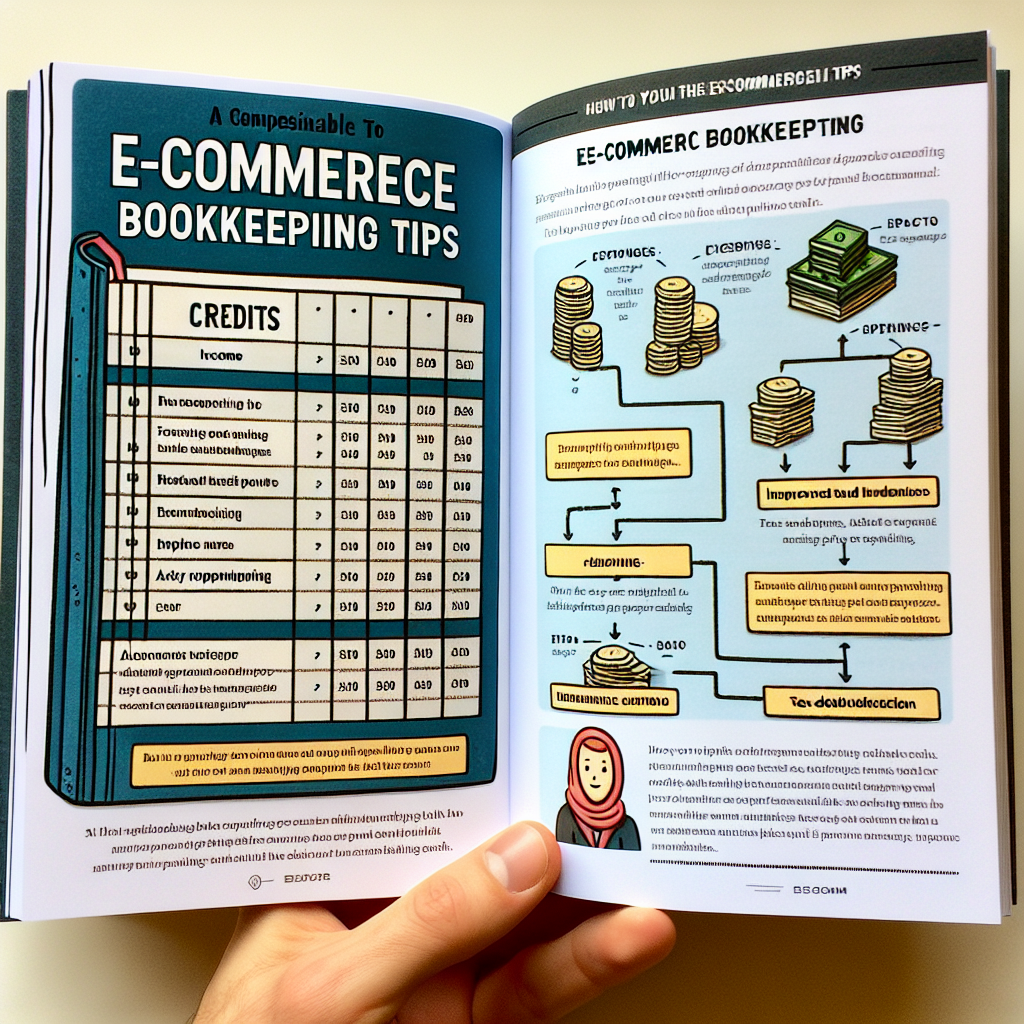

What is ecommerce bookkeeping?

Ecommerce bookkeeping is the practice of recording, tracking, and managing financial data in order to fuel your ecommerce accounting accurately. 86% of ecommerce owners polled by Finaloop list the lack of ecommerce-specific accounting knowledge as one of the main reasons they are looking to replace their current bookkeeping service. This begs us to ask the question, “Is ecommerce bookkeeping really that different?” The basic structure of all bookkeeping is generally the same. You’ve got your assets, liabilities, equity, income, and expenses. But, the breakdown of each category, the specific issues important for you to understand for your business, and the technology needed to properly record all transaction details are dramatically different from your brick & mortar or service business counterparts. Many DTC owners and bookkeepers alike take the standard Quickbooks or Xero bookkeeping process, add an Intuit ecommerce service or third-party integration with their online store, point-of-sale systems, fulfillment, and other ecommerce platforms … then, consider this ecommerce bookkeeping. Adding ecommerce integrations is only one piece of the puzzle in making your books ecommerce-friendly. There are many real differences between regular bookkeeping and ecommerce bookkeeping that also need to be taken into account (yup, pun intended).

What mistakes do bookkeeping services and accounting software make?

Here we’ll share the top 6 bookkeeping differences between ecommerce businesses and physical stores that should be considered by you or any bookkeeping service you choose so you can maintain your books accurately. These are the 6 most common mistakes we see done by non-ecommerce bookkeepers.

- No big picture view of your real income

- Gross margin is calculated differently

- Inventory management is multi-faceted

- Ecommerce financing has different rules

- Sales tax is exponentially more complicated

- Chart of accounts is not ’one size fits all’

- No big picture view of your real income

For non-ecommerce businesses, you see a deposit in your bank of $220, you record income of $220. It’s not rocket science. For ecommerce, it’s not quite so simple. A deposit of $220 from Shopify, Amazon, or Walmart, is not $220 of income. It could mean, $300 of income, $60 of returns, and $20 of merchant fees. It could also mean that of the $220, $15 is actually sales tax you owe to the tax authorities. In other words, just like your relationship status, it’s complicated.

Using technology such as AI accounting and AI bookkeeping to integrate with your online stores (like Shopify), marketplaces (like Amazon), payment processors (like Paypal, Afterpay, or Stripe), or your other apps, can significantly reduce your errors, give you a full big picture view into your revenue and save you time on bookkeeping.

Harnessing the power of automation here allows you to pull the data directly from your platforms into your books on a real-time basis. You can automate the full bookkeeping process start-to-finish using an automated bookkeeping service like Finaloop, which uses its own proprietary integrations to ecommerce platforms like Shopify, Amazon, Walmart, Etsy, Paypal, Stripe, AfterPay, etc. to pull your data and complete your bookkeeping process on a real-time basis. Using an integration also allows you to track your undeposited funds, i.e., the remaining balances in your Shopify, Amazon, Paypal, or any other store or payment gateway, that has not yet been deposited into your bank account. This is important to track for both accounting and tax purposes and to give you a better view of your expected cash flow.