Understanding International Ecommerce Sales

Delving into international ecommerce sales isn't just about expanding your market reach; it's a complex dance of financial acumen. At the core, understanding the basics—currency exchanges, tax implications, and compliance with local laws—is crucial. But let's dig deeper. Currency exchange isn't just about converting prices; it's about strategizing pricing models to accommodate fluctuating exchange rates without eroding profit margins.

When it comes to taxes, the plot thickens. Navigating international tax laws requires a keen understanding of not just your home country's regulations but also those of every country you sell into. This could mean grappling with VAT, GST, or HST, and knowing when to charge them. Compliance is another beast altogether. Each market has its own set of rules, from data protection to consumer rights, and falling foul of these can be costly.

But fear not, this intricate web is navigable. By leveraging insights from resources like ecommerce financial reporting and staying abreast of international accounting standards, you can turn these challenges into opportunities for growth and profitability. Remember, knowledge is power in the dynamic world of international ecommerce.

Accounting for Currency Exchange Fluctuations

Understanding the intricacies of currency exchange is pivotal for any ecommerce business venturing into the international arena. The volatility of currency rates can significantly impact your revenue and profit margins, making it essential to have a robust strategy in place for accounting for currency exchange fluctuations.

- Real-Time Analysis: Stay ahead by using real-time currency data to make informed pricing decisions. This proactive approach allows for immediate adjustments in response to market movements.

- Hedging Strategies: Implement hedging to protect against unfavorable shifts. Options like forward contracts can lock in exchange rates for future transactions, providing a cushion against sudden changes.

- Multi-Currency Accounting Software: Leverage technology to streamline the process. Sophisticated software can automate the conversion and reconciliation of transactions in multiple currencies, reducing errors and saving time.

- Diversified Currency Holdings: Maintain balances in various currencies to offset potential losses. This tactic can be beneficial if you have recurring costs in those currencies.

But it's not just about defense. Savvy ecommerce entrepreneurs can turn currency fluctuations into an advantage. By analyzing trends, you can time your market entry or product launches to coincide with favorable exchange rates, maximizing returns. Additionally, consider pricing your products in the customer's local currency to enhance their shopping experience and potentially increase conversion rates.

Don't forget the importance of streamlining ecommerce accounting with automation tools. These can provide valuable insights into your financial health, allowing you to make strategic decisions quickly. Moreover, integrating these tools with your ecommerce platform can facilitate seamless international transactions.

Ultimately, the goal is to create a balance between risk management and opportunity maximization. By understanding and implementing these strategies, you can navigate the tumultuous waters of international ecommerce with confidence, ensuring that currency exchange fluctuations become a manageable aspect of your global expansion, rather than an insurmountable obstacle.

Compliance and Tax Strategies

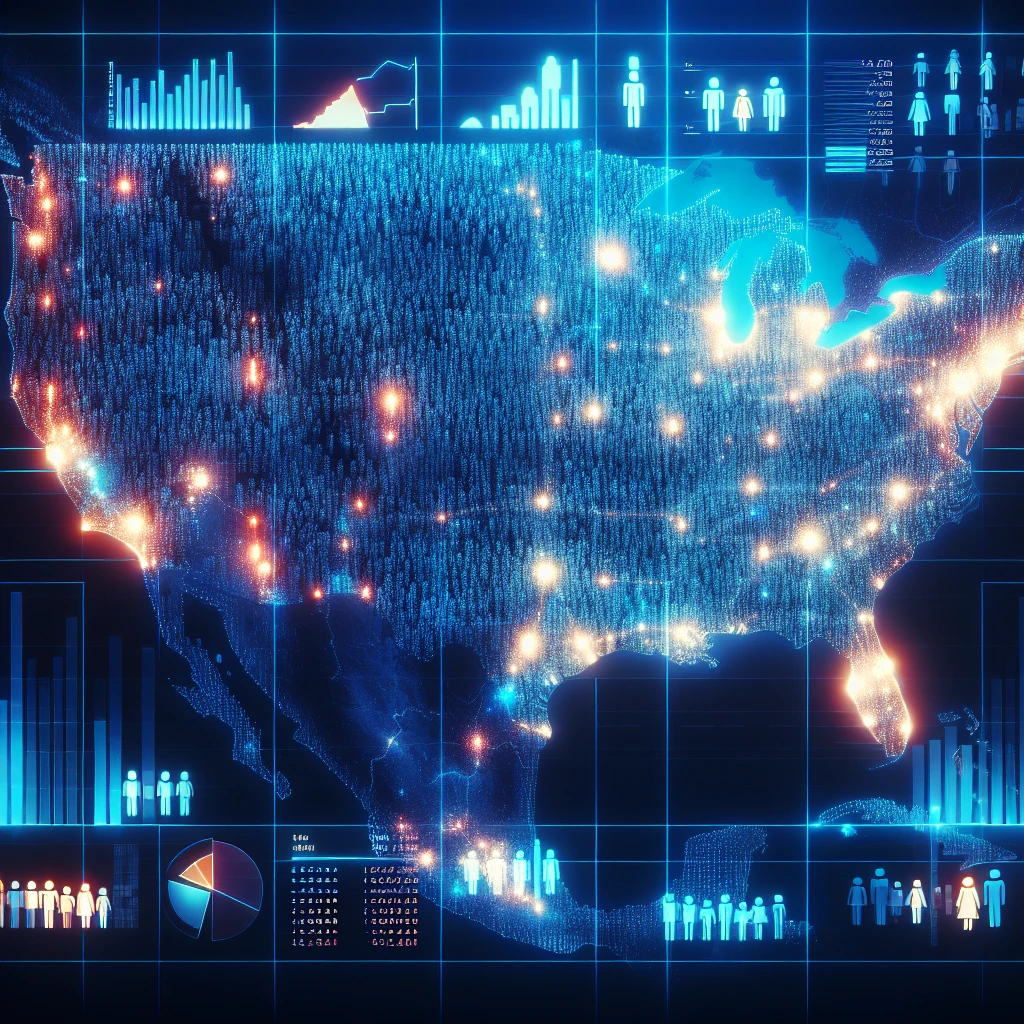

As we delve into the complexities of international ecommerce accounting, it's critical to address the elephant in the room: compliance and tax strategies. The digital age has dissolved borders, allowing businesses to reach global markets with ease. However, this expansion comes with a labyrinth of tax laws and regulations that can ensnare the unprepared entrepreneur.

First and foremost, understanding and adhering to international tax laws is non-negotiable. This means keeping abreast of the tax requirements in each jurisdiction where you operate. Failure to comply can result in hefty fines, legal issues, and damage to your brand's reputation. Here are some best practices to ensure you stay on the right side of the law:

- Local Expertise: Engage with local tax consultants or legal experts who can provide insights into the specific tax obligations of each market you're targeting.

- Regular Audits: Conduct regular audits to ensure that all international transactions are recorded accurately and that you're meeting tax obligations in each country.

- Up-to-Date Records: Maintain meticulous records of all international sales, expenses, and taxes paid. This will not only aid in compliance but also in strategic tax planning.

Speaking of tax planning, it's a crucial component for optimizing your financial performance across borders. Implementing efficient tax strategies can lead to significant savings and a stronger bottom line. Consider these strategies for efficient tax planning:

- Transfer Pricing: Utilize transfer pricing strategies to allocate profits within your company in a way that minimizes tax liabilities across different jurisdictions.

- Tax Treaties: Take advantage of tax treaties between countries to reduce withholding taxes on international payments and avoid double taxation.

- E-commerce Specific Deductions: Identify and leverage e-commerce specific deductions, such as those for website development and maintenance, as outlined in our article on 5 must-know tax deductions for ecommerce businesses.

It's also imperative to stay informed about the ever-evolving tax landscape. For instance, the OECD's Base Erosion and Profit Shifting (BEPS) project aims to combat tax avoidance strategies that exploit gaps and mismatches in tax rules. Being proactive and staying updated on such developments can save you from future headaches.

In conclusion, navigating the complexities of international ecommerce accounting requires a strategic approach to compliance and tax planning. By implementing best practices and staying informed, you can turn what seems like an arduous task into a competitive edge, ensuring your business thrives in the global marketplace.