Understanding TurboTax: An Overview

Alright, let's dive right into this. TurboTax, ever heard of it? If not, you're about to get a crash course. TurboTax is a game-changer, a tax software that's been designed to make your life easier. It's all about simplifying the complex world of taxes, and trust me, it does a damn good job.

So, what's the deal with TurboTax? Well, it's got a bunch of core features that are worth shouting about. First off, it guides you step by step through the tax filing process. No more scratching your head over complicated tax forms. It's like having a tax expert right there with you. And the best part? It's tailored to you. It asks simple questions about your life and gives you the tax deductions and credits you're eligible for. Talk about personalized service.

Now, TurboTax isn't a one-size-fits-all kind of deal. It's got different versions to suit different needs. There's the Free Edition for simple tax returns. Then there's the Deluxe version, which is great for maximizing tax deductions. And for those self-employed hustlers out there, there's the Self-Employed version. Plus, there's even a version for corporations, partnerships, and LLCs. So, whatever your situation, TurboTax has got you covered.

But what really sets TurboTax apart is how it simplifies the tax filing process. It takes something that's typically a headache and turns it into a breeze. It's all about making it as easy as possible for you. It does all the hard work, so you don't have to. It calculates your tax liability or refund, fills in all the right forms, and even checks for errors. All you have to do is answer some questions. It's that simple.

So, there you have it. That's TurboTax in a nutshell. It's a powerful tool that's revolutionizing the way we do taxes. But don't just take my word for it. Give it a try and see for yourself. Trust me, once you go TurboTax, you'll never go back.

The Benefits of Using TurboTax for Tax Filing

Alright, let's get right into it. TurboTax - it's a game changer. Why? Because it's like having a personal tax assistant, but without the eye-watering fees. It's got a user-friendly interface that's as easy as pie to navigate, even if you're not a tech whiz. Trust me, it's simpler than assembling an IKEA chair.

But don't just take my word for it. Here's what Joe, a small business owner, had to say: 'I used to dread tax season. It was like a dark cloud hanging over me. But TurboTax? It's like the sun breaking through the clouds. It's straightforward, and it gets the job done.' That's real talk, right there.

Now, let's talk accuracy. TurboTax has got it in spades. It's like a sniper - it doesn't miss. It's got a built-in error checker that'll catch those pesky mistakes that could cost you big time. It's like having a safety net, ensuring you don't trip up on those complicated tax laws.

And the time-saving features? They're the real MVP. TurboTax automatically imports your W-2s and 1099s, so you don't have to manually enter every. single. detail. It's like having a personal assistant who does all the grunt work for you. Plus, it's got a feature that allows you to take a snapshot of your charitable donations and it'll calculate the deductions for you. It's like having a magic wand that makes tax filing a breeze.

Here's another testimonial, this time from Sarah, a freelance writer: 'As a freelancer, I have multiple income sources, and TurboTax makes it easy to organize and file everything. Plus, their customer support is top-notch. They're always there to help, no matter how small or big the issue.'

So there you have it. TurboTax - it's like having a cheat code for tax filing. It's user-friendly, accurate, and it saves you precious time. It's not just about making tax filing easier, it's about making your life easier. And who doesn't want that?

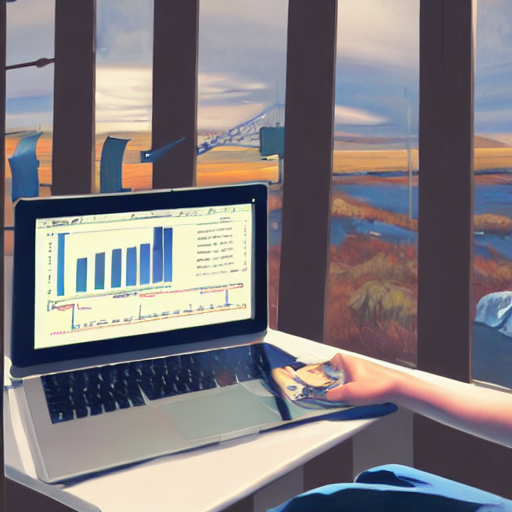

TurboTax vs. Traditional Tax Filing: A Comparison

Alright, let's get down to business and talk about TurboTax versus traditional tax filing methods. We're living in the digital age, my friends, and it's time to embrace the tools that make our lives easier, more efficient, and less stressful. So, let's dive in and see how TurboTax stacks up against the old school way of doing things.

First up, let's talk about time. You know that time is money, right? Well, according to a report from the IRS, the average taxpayer spends 13 hours preparing their tax return. That's half a day you could be spending on your business, with your family, or just chilling out. TurboTax, on the other hand, can cut that time down significantly. With its intuitive interface and step-by-step guidance, you could have your taxes done in a few hours. That's a game changer, folks.

Next, let's talk about cost. Hiring a tax professional can set you back anywhere from $200 to $500, depending on the complexity of your return. TurboTax, on the other hand, offers a range of packages starting at just $60. Plus, they offer a free edition for simple tax returns. And let's not forget, with TurboTax, you're not just paying for a service, you're investing in a tool that empowers you to take control of your financial future.

Finally, let's talk about accuracy. We all know the stress of worrying about making a mistake on our taxes. The IRS reported that the error rate for paper returns is 21%, compared to just 0.5% for e-filed returns. TurboTax uses a combination of technology and tax expertise to ensure your return is accurate and maximizes your refund. They even offer a maximum refund guarantee.

So, there you have it. TurboTax is faster, more affordable, and more accurate than traditional tax filing methods. It's a no-brainer, folks. Embrace the future and take control of your taxes with TurboTax.

Getting Started with TurboTax: A Step-by-Step Guide

Let's get real, folks. Tax season can be a real pain in the neck. But it doesn't have to be. Not if you're using TurboTax. This software is a game-changer. It's like having a personal accountant in your pocket, ready to tackle your tax filing needs 24/7. So, let's dive in and get you started with TurboTax. It's time to turn tax season from a headache into a breeze.

First things first, you've gotta set up an account. Head over to TurboTax's website and click on that 'Create a new account' button. Fill in your details. Easy peasy. But remember, your security is paramount. Choose a strong password. TurboTax will keep your information safe, but you've got to do your part too.

Next, you've got to choose the right version for you. TurboTax offers several versions, each tailored to different tax situations. If you're a freelancer, go for TurboTax Self-Employed. Got investments and rental property? TurboTax Premier's got your back. For the average Joe with a W-2, TurboTax Deluxe should do the trick. Choose wisely, my friends.

Now, it's time to start the tax filing process. TurboTax's interface is user-friendly and intuitive. It guides you through each step, asking simple questions about your income and expenses. All you've got to do is answer honestly. TurboTax will do the rest, calculating your tax liability or refund. It's like having a conversation with a friendly accountant who's got your best interests at heart.

So, there you have it. A step-by-step guide to getting started with TurboTax. It's not rocket science. It's just a smarter, simpler way to handle your taxes. And remember, TurboTax is there to help, not to complicate things. So, don't stress. Just take it one step at a time. You've got this.