Understanding Avalara: An Overview

Alright, let's dive into this. Avalara, ever heard of it? If you're in the ecommerce game, you should have. This isn't just another software company, it's a game-changer in the world of ecommerce tax management. So, let's break it down, what is Avalara and why should you care?

Avalara is a cloud-based solution designed to automate and simplify the complex world of sales tax. It's like having a tax expert in your pocket, ready to handle everything from calculations to returns. And it's not just for the big players. Whether you're a small start-up or a global corporation, Avalara has got your back.

Now, let's take a quick trip down memory lane. Avalara was founded back in 2004, with a mission to deliver affordable, accessible tax compliance solutions. Fast forward to today, they're a leading provider of tax compliance automation for businesses of all sizes. They've got more than 20,000 customers worldwide and they're not slowing down.

But why is this important? Why should you care about tax automation? Here's the thing, in the world of ecommerce, tax compliance isn't just a nice-to-have, it's a must-have. The rules are complex and ever-changing. One wrong move and you could be facing hefty fines, or worse. That's where Avalara comes in. They take the guesswork out of tax compliance, so you can focus on what you do best - running your business.

So, if you're not using Avalara, or a solution like it, you're not just leaving money on the table, you're risking your business. It's time to step up your game. It's time to understand Avalara.

Features of Avalara: What Makes It Stand Out

Alright, let's dive right into the meat of the matter: what makes Avalara stand out in the crowded world of ecommerce tax management? You see, it's not just about doing the bare minimum; it's about going the extra mile. And that's exactly what Avalara does.

First up, Avalara's got this killer feature: automation. We're living in a world where time is money, and automation is the key to saving both. Avalara automates the tedious task of tax calculation, preparation, and remittance. It's like having a tax expert on your team, working 24/7, without the hefty salary. Now, that's what I call working smart!

But wait, there's more. Avalara isn't just about US taxes. Nope. It's got global ambitions. With Avalara, you've got a tool that's well-versed in international tax laws. So, whether you're selling your products in Peoria or Paris, Avalara's got your back. It's like having a globe-trotting tax guru at your disposal.

Now, let's talk about accuracy. In the world of taxes, a tiny error can cost you big time. But with Avalara, you can kiss those worries goodbye. Avalara's tax engine is powered by advanced algorithms and up-to-date tax data, ensuring you're always on the right side of the taxman. It's like having a personal tax auditor, minus the cold sweats.

And then there's the ease of integration. Avalara plays nice with your existing business systems. Whether you're using Shopify, Magento, or any other ecommerce platform, Avalara seamlessly integrates, making tax management a breeze. It's like adding a turbocharger to your ecommerce engine.

Finally, let's not forget about Avalara's top-notch customer support. In the unlikely event that you encounter a hiccup, Avalara's support team is just a call or click away. It's like having a dedicated pit crew for your ecommerce race car.

So, there you have it. Avalara isn't just another tax management tool; it's a game changer. It's about working smarter, not harder. It's about going global without the headaches. It's about accuracy, integration, and peace of mind. And that, my friends, is why Avalara stands out.

Benefits of Using Avalara for Your Ecommerce Business

Listen up, folks! If you're running an ecommerce business, you know how much of a pain tax management can be. It's not just about crunching numbers, it's about understanding complex tax laws, staying up-to-date with changes, and ensuring compliance. That's where Avalara comes in, and let me tell you, it's a game changer.

First off, Avalara automates the whole tax calculation process. That means no more manual calculations, no more errors, and no more headaches. It's like having your own personal tax expert, working 24/7 to make sure your business is on point. But don't just take my word for it. Let's look at some real-life examples.

Take Company X for instance. They were struggling with tax compliance, spending hours every week trying to figure things out. Then they switched to Avalara. Now, they're saving time, reducing errors, and focusing on what really matters: their business. That's the power of automation, my friends.

But Avalara isn't just about automation. It's about accuracy too. The software is constantly updated to reflect the latest tax laws and regulations. That means you can rest easy, knowing your business is always compliant. Company Y can vouch for this. They were hit with a hefty fine for non-compliance. But since switching to Avalara, they've had zero issues. Zero!

And let's not forget about scalability. As your business grows, your tax obligations become more complex. Avalara grows with you, handling everything from sales tax to VAT, for any number of products, in any number of locations. Just ask Company Z. They expanded their operations overseas and were overwhelmed with the new tax obligations. Avalara took care of it all, allowing them to focus on their expansion.

So there you have it. Avalara isn't just a software, it's a solution. A solution to the time-consuming, headache-inducing, business-hindering problem of tax management. And the benefits are clear: automation, accuracy, and scalability. But don't just take it from me, or from Companies X, Y, and Z. Try it for yourself. See the difference Avalara can make for your ecommerce business.

Getting Started with Avalara: A Step-by-Step Guide

Alright, let's cut to the chase. You're here because you want to know how to get started with Avalara, right? Well, you're in luck. I'm going to break it down for you, step by step. No fluff, no jargon, just straight-up facts. Let's get into it.

First things first, you've got to sign up. Head over to Avalara's website and click on that big, beautiful 'Sign Up' button. Fill in your details, and boom, you're in. But that's just the beginning.

Once you're in, you'll find yourself in Avalara's interface. Now, I know what you're thinking. 'Oh no, another complicated dashboard to figure out.' But trust me, Avalara's interface is as user-friendly as they come. It's clean, it's intuitive, and it's designed to make your life easier. So don't stress, just explore.

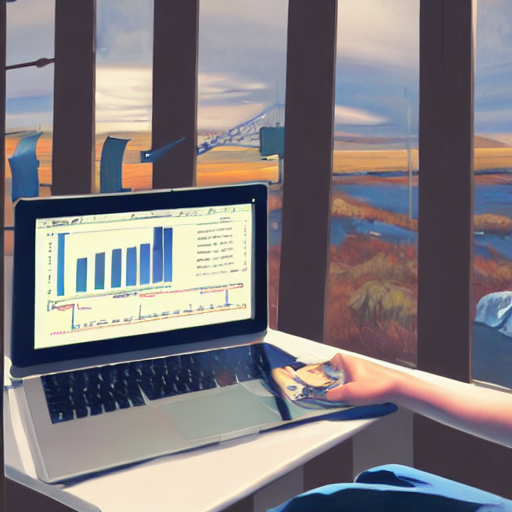

Now, let's talk features. Avalara is packed with them, and they're all there to help you manage your ecommerce business's taxes like a pro. From automated tax calculations to comprehensive reporting tools, Avalara has got you covered. So take the time to familiarize yourself with these features. Trust me, it's worth it.

But what's the point of all these features if you don't know how to use them, right? That's why Avalara provides a wealth of resources to help you get the most out of their platform. From detailed guides to helpful videos, they've got everything you need to become an Avalara power user. So don't be shy, dive in and start learning.

And lastly, don't forget to reach out to Avalara's support team if you ever need help. They're there to assist you, and they're pretty darn good at it. So don't struggle in silence, reach out and get the help you need.

So there you have it, a step-by-step guide on how to get started with Avalara. It's not rocket science, it's just about taking the time to learn and understand. And remember, the more you put in, the more you get out. So get out there, start exploring Avalara, and revolutionize your ecommerce tax management. You've got this.